I’ve Reviewed 100s of Investment Newsletters Over the Past 4+ Years. This Is My Top Pick.

It’s called Insider Newsletter and it’s run by two money managers who target 3x+ returns by investing in stocks that most money managers wouldn’t touch with a 20-foot pole.

And, they practice what they preach, meaning that they invest in their recommendations, ie. they have skin in the game.

Sometimes this is frowned upon in the investment newsletter industry, but I see it as a good sign.

After all, how much can you trust a stock recommendation someone is making if they aren’t even putting their own hard-earned cash into it?

Have you ever heard of Insider Newsletter?

I’m guessing the answer is probably not, and there’s a good reason for this.

While The Motley Fool, InvestorPlace, Stansberry Research, etc. are spending millions of dollars on marketing content – we all know those misleading hyped-up investment teasers – the guys running Insider Newsletter are spending their time and resources actually providing the best investment newsletter service possible.

It’s a small operation.

I happened to stumble upon Insider Newsletter pretty much by luck back in September 2020 and have been a happy member ever since.

You’ll see why.

Investing in ‘toxic waste’ stocks at rock-bottom prices

As they’ve mentioned before:

“We’re buying these things when they’re absolute toxic waste”.

This is a quote from one of the two guys running the newsletter.

Instead of chasing trends and looking for the hottest tech stocks like many other services out there, Insider Newsletter is focused on buying stocks when no one else wants them.

You certainly won’t see them recommending that you buy Nvidia when everyone and their mothers are talking about it and we have the CEO out there signing autographs like a rockstar on tour..

Instead, they look for entire sectors that are out-of-favor, yet still vital for the functioning of society and they invest there.

For example, there aren’t many sectors that have taken a beating like coal.

It’s been treated like a criminal and shunned more than just about anything.

The Economist even talked about it becoming ‘history’.

With all this negative attention and the push to eliminate use of this fossil fuel, you can imagine how much divestment this industry has seen.

No money managers want to touch coal stocks. And most would probably be fired if they did.

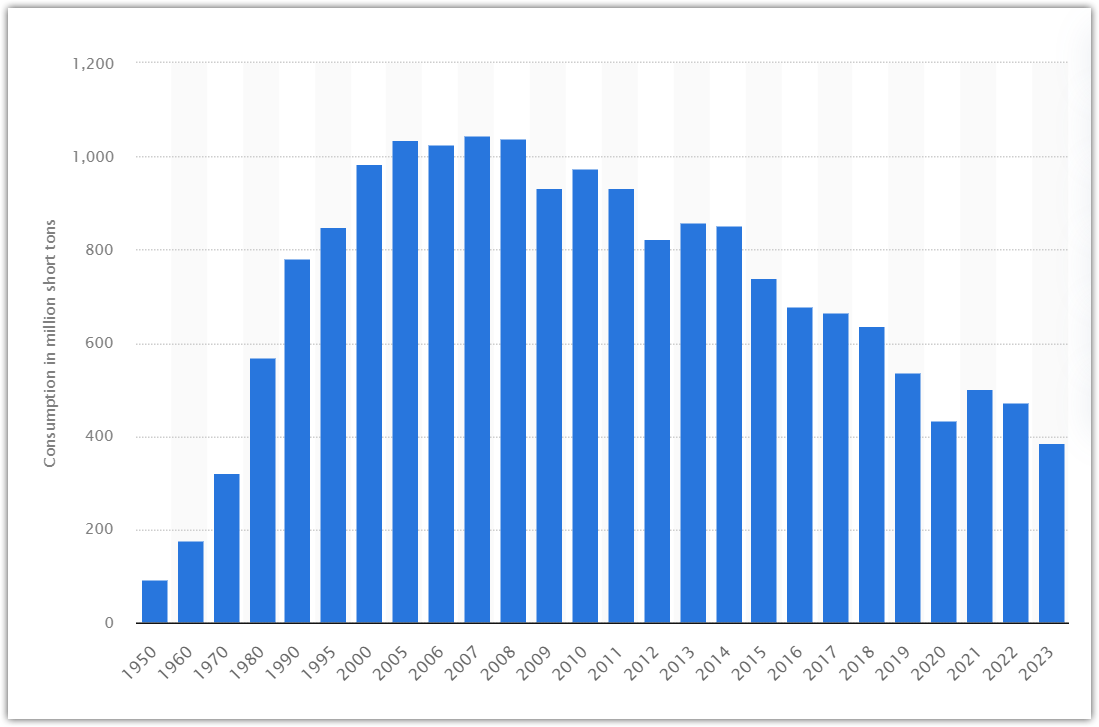

It’s no wonder we’ve seen coal consumption plummet over the past decade and a half in the US..

But, things aren’t always what they first seem to be.

The guys behind Insider Newsletter don’t usually buy into the mainstream narrative, and this is one reason they like coal.

They go against the grain. But not just because they like to, but because that’s often where the deep-value opportunities lie.

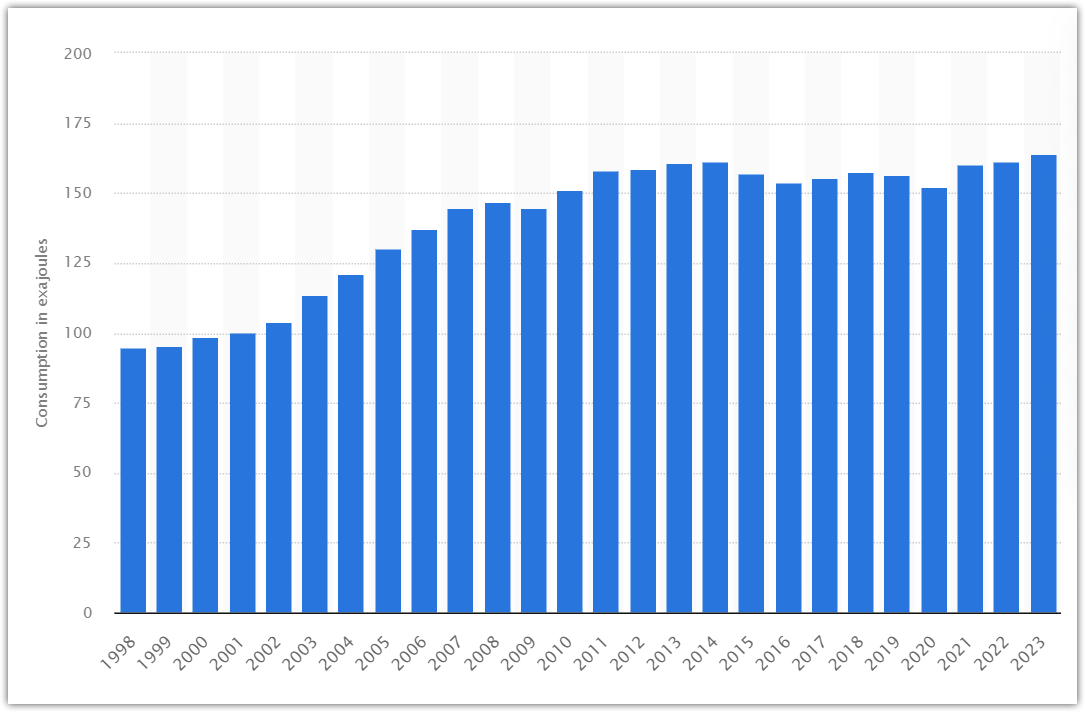

Coal stocks have been trading at extremely low valuations – rock-bottom prices, and the reality is that, while the US has been decreasing coal use, global coal use has been on a steady rise..

Call them old school if you want, but the fact of the matter is that in order to meet our energy needs, we still need a reliable base-load energy like coal at this point in time.

When this thesis changes, they’ll adjust to the times and find other deep-value opportunities.

Looking for 3 – 10x+ by investing at the bottom

Just like empires rise and fall, so do stocks.

The markets often go through cycles and if you can get in at the bottom of a cycle and ride it out, this is where you stand a chance of making good money.

This all ties into the whole targeting ‘out-of-favor’ stocks thing.

By targeting ‘out-of-favor’ stocks, naturally you are often targeting stocks that are at the bottom of a market cycle.

Some real examples from Insider..

And as they usually say, the size and duration of these cycles is usually bigger than expected, making selling too early one of the biggest problems to expect.

The guys behind Insider Newsletter

Being a contrarian investment newsletter and often going against the crowd, you might be able to imagine that these guys say things how they see them.

Chris Macintosh is the main one behind Insider Newsletter..

He calls a spade a spade and doesn’t shy away from controversial topics if they are somehow related to investing, of which politics often are.

So don’t be surprised. He can talk like a sailor at times.

Chris is who you’ll hear the most from. He’s the one who writes the newsletters and provides the global macro-view contrarian investment ideas.

Before deciding to launch the Insider Newsletter back in 2016 (used to be called Insider Weekly) and start his own money management business, his background included working at large investment banks such as JPM, Lehman, Robert Flemmings, and Investco.

I’m not 100% sure on this, but being a member for over 4 years now, it seems to me that Brad is mostly involved with some of the behind-the-scenes analysis of picking the better stock options in the out-of-favor sectors that they identify.

You won’t hear from him as much, although he does chime in from time to time in the newsletters, but rest assured he’s back there putting in the work to bring us investment opportunities that simply aren’t found elsewhere.

Brad was a money manager at Henry Ansbacher and also managed a trading book for Rand Merchant Bank (both are from South Africa by the way) before Insider Newsletter.

*Chris and Brad have a money management business called Glenorchy Capital where they manage money for high-net-worth clients. Insider Newsletter follows the same exact investment strategies.

How Insider Newsletter works

Insider Newsletter is usually sent out biweekly and generally consists of anywhere from 30-50 pages of unique investment research and market analysis.

No BS.

No hype.

Just the important stuff.

Essentially, Insider Newsletter is a curated report of what Chris and Brad, who let’s not forget are professional money managers with the single goal of profiting from the current market at hand, deem important enough to share.

Chris is a well-traveled man and has a global view with investing. So be ready to hear talk from a wide-angle macro view.

- Geopolitical events and their effects on markets

- Supply and demand issues and how we can position ourselves to capitalize on them

- Capital flows in and out of various sectors and what they mean for us as investors

- Talk about inflation, ever-rising state debt, the dying bond market, and how we can profit from the inevitable

- And a whole lot more

These are some things you can expect to hear about.

But at the end of the day, there’s just one goal in mind.

No matter what craziness is going on in the world and in the global markets, Chris and Brad are looking to profit.

I’ll admit, there is some doom and gloom in the newsletters. How can that be avoided with what’s going on in the world? But in the end they bring us unique ways to profit from it all and this is what we want.

And just to give you an idea of the layout of these newsletters, each one usually starts out with a nice sunset photo sent in from a subscriber (Chris is a big fan of sunsets)..

Then you get the meat and potatoes of the newletter, and at the end you’ll find ‘The Big Five’, which are described as:

“Five interesting long-term setups – unloved and totally off the radar of the average fund manager.”

First comes all the geopolitical and market news, and then at the end the actionable investment ideas.

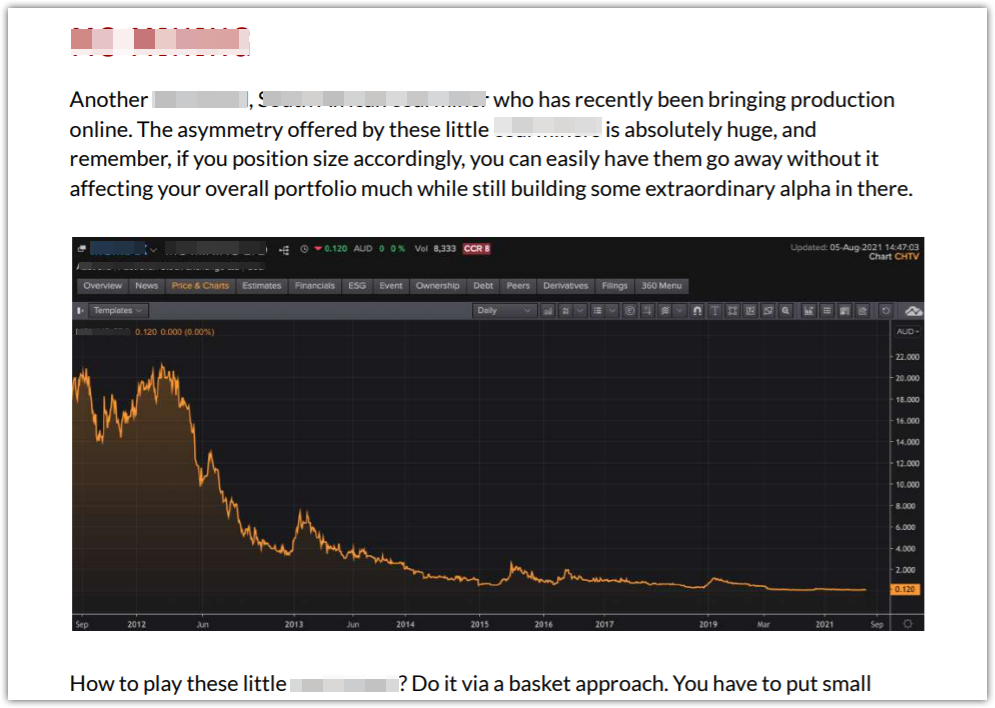

For these picks, you’ll find all the reasons Chris and Brad have chosen them along with charts that show how much asymmetry is there..

They’re trying to get in on the bottom, remember?

How you can join today for just $1

At the moment, they’re running a special offer where new members can join for just $1 for the full first month.

After this first month, the price will go up to the normal $35 per month.

Either way you look at it, it’s worth it.

Even if there was no special offer and the price was just $35/mo to start, I’d still be recommending it because I’ve been a member for several years now and I know how much value is provided here.

If your looking to improve your financials and like the idea of investing in out-of-favor stocks that are selling at huge discounts, give it a try.

You can always cancel if you chose to.

*You’ll get access to the latest newsletter issue immediately upon signup.

Why I recommend Insider Newsletter so much

I really took a deep dive into the investment newsletter space starting back in early 2020 and have reviewed hundreds of investment newsletters since then.

Right now, Insider Newsletter is still my top pick.

It isn’t for everyone.

After all, they do focus on long-term investments with a 5-year time frame in mind and this may not be what you are looking for. But as it’s been said: ‘Patience is bitter, but its fruit is sweet.’

So if a long-term approach is what you fancy and you agree with their old-school investment approach rather than that of chasing the next ‘hottest’ stock, which most seem to do, then you’ll feel right at home with Insider Newsletter.

And I’m far from the only one who feels this way.

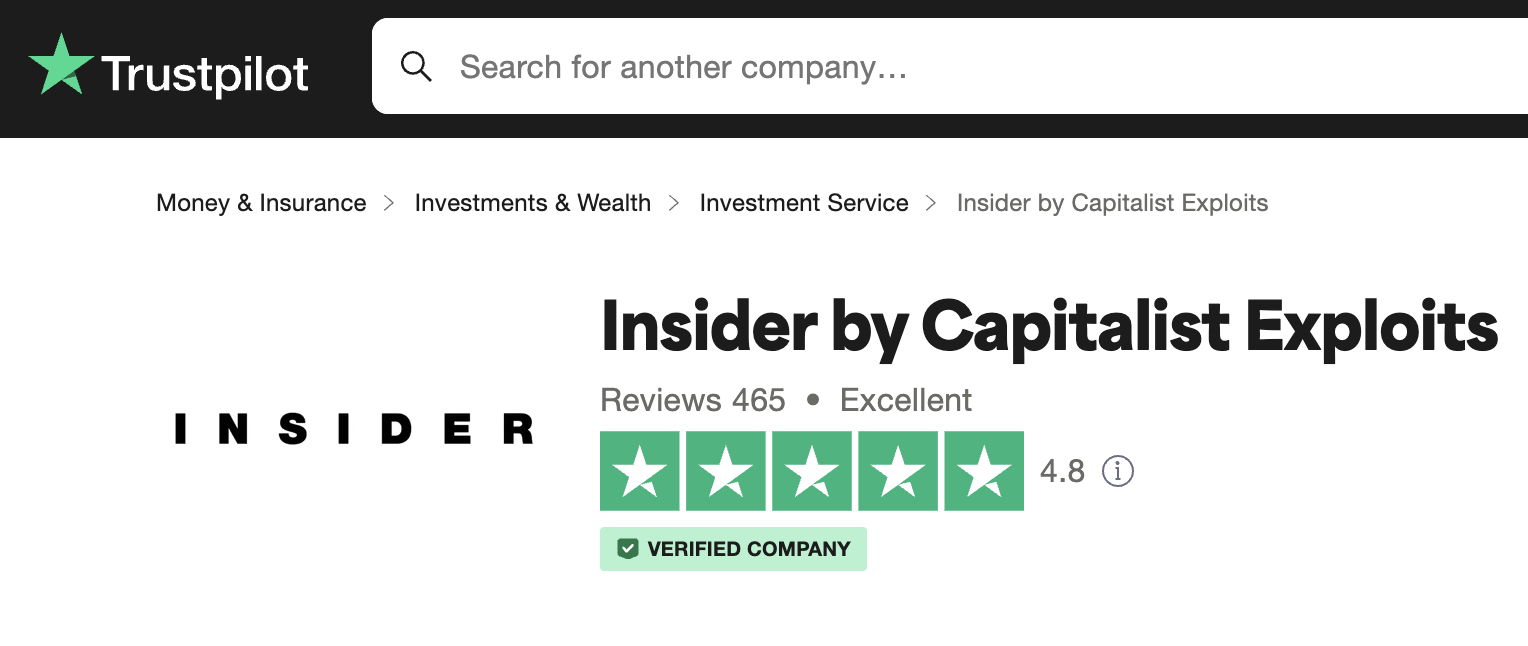

If you look on Trustpilot, which is a website where anyone can leave reviews for services like this, their Insider service has a 4.8 out of 5 star rating..

For anyone familiar with this space, you know that a rating like this is unheard of.

Some highlights I found include this one from a 20+ year investor who claims “This is by far the best service I’ve come across”..

And here we have someone calling it a “rare gem” that “you will simply not find anywhere else”..

And, of course, there is “no hype, no need for mass marketing”, which is something I’ve mentioned – one of the reasons this service isn’t all that well-known.

Just remember, Chris says it how he sees it. He can be a bit controversial at times, but I suppose that’s just the contrarian in him.

If you have an open mind and an ultimate goal of building your wealth, I’m sure you’ll see the immense value that’s provided in these newsletters and understand why I’ve been a member since 2020.