If you’re looking for an honest review of Motley Fool’s Stock Advisor service then look no further my friend.

Since I review and expose stock teasers here at stock sleuther and since The Motley Fool is always teasing stocks to lure people into their Stock Advisor service, I felt compelled to join the service and actually see how good it is for myself.

In this review, I’ll be going over what his service actually provides and will be putting a lot of focus on their stock pick performance.

Of course, anyone who joins TMF’s Stock Advisor service is looking to make money. But what are the chances you’ll actually make any decent money following their investment recommendations?

Let’s find out.

Before joining

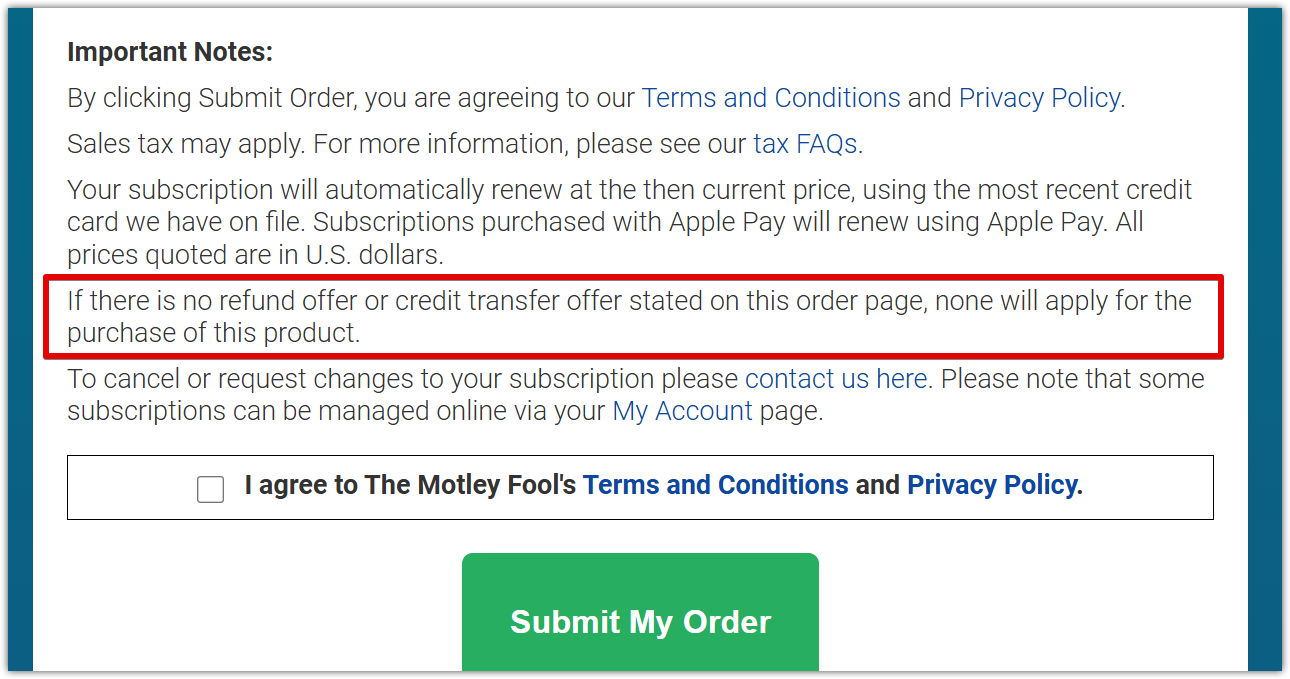

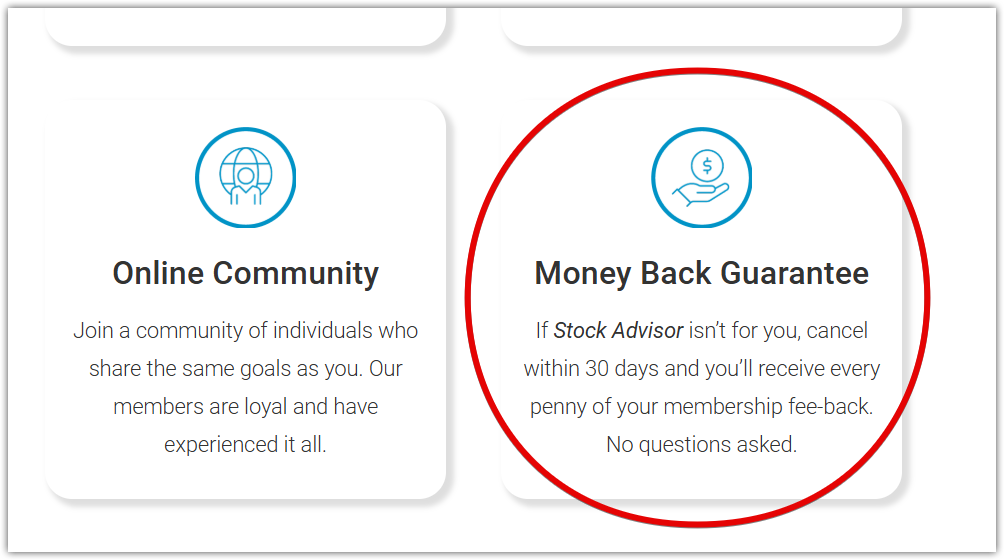

Before I joined, I made sure that there was a sound refund policy in place. This is important in the world of investment newsletter service where there are quite a few that don’t offer money-back refunds, but rather credits towards other newsletters they sell.

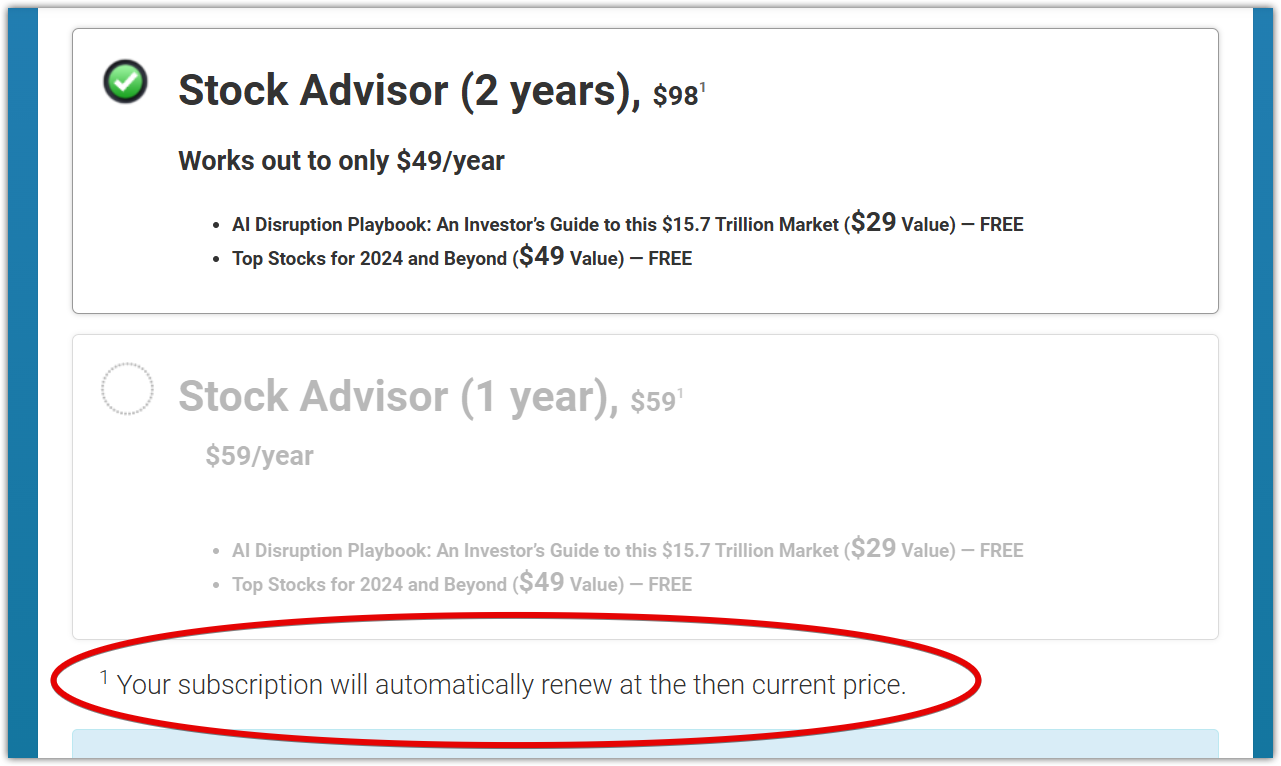

I came across a special offer to get Stock Advisor for 2 years for $98. But you want to be careful here and always read the fine print, as you can see that it states that the renewal cost will be the ‘current’ price at the time of renewal… which means it is pretty much guaranteed to be more.

Not only this, but if there’s ‘no refund or credit transfer offer stated on the order page, none will apply for the purchase.’

So you better look and make sure.

The offer I landed on did state a 30-day money-back guarantee, so I went ahead and bought it.

Then I was bombarded with the chance to upgrade to their Epic service for another $195 per year, but I turned this down.

A brief overview

First off, what exactly is Stock Advisor?

We know it’s an investment newsletter service, but more than this it’s a wide-range stock-picking service that doesn’t have any single market sector focus, but rather looks to invest in stocks that they think are going to beat the market (the S&P 500) over the next 5 years and longer and provides recommendations twice per month.

Now, they say that it ‘does not focus on a single area of the market’, but from my perspective, it does, at least somewhat leaning towards investing in innovative technology companies.

*My favorite stock newsletter does the opposite, instead targeting ‘boring’ out-of-favor companies for 3-10x gains.

Furthermore, Stock Advisor is their introductory stock-picking service and being so is more risk-averse – meaning it targets larger and more stable companies.

What this means is that it’s unlikely that their picks will return astronomical gains, although as I’ll go over when I cover the performance of their picks, some have.

The ‘principles of success’ that they want subscribers of Stock Advisor to follow include:

- Buy 25 or more companies recommended by The Motley Fool over time

- Hold those recommended stocks for 5 years or more

- Invest new money regularly

- Hold through market volatility

- Let your portfolio’s winners keep winning

- Target long-term returns

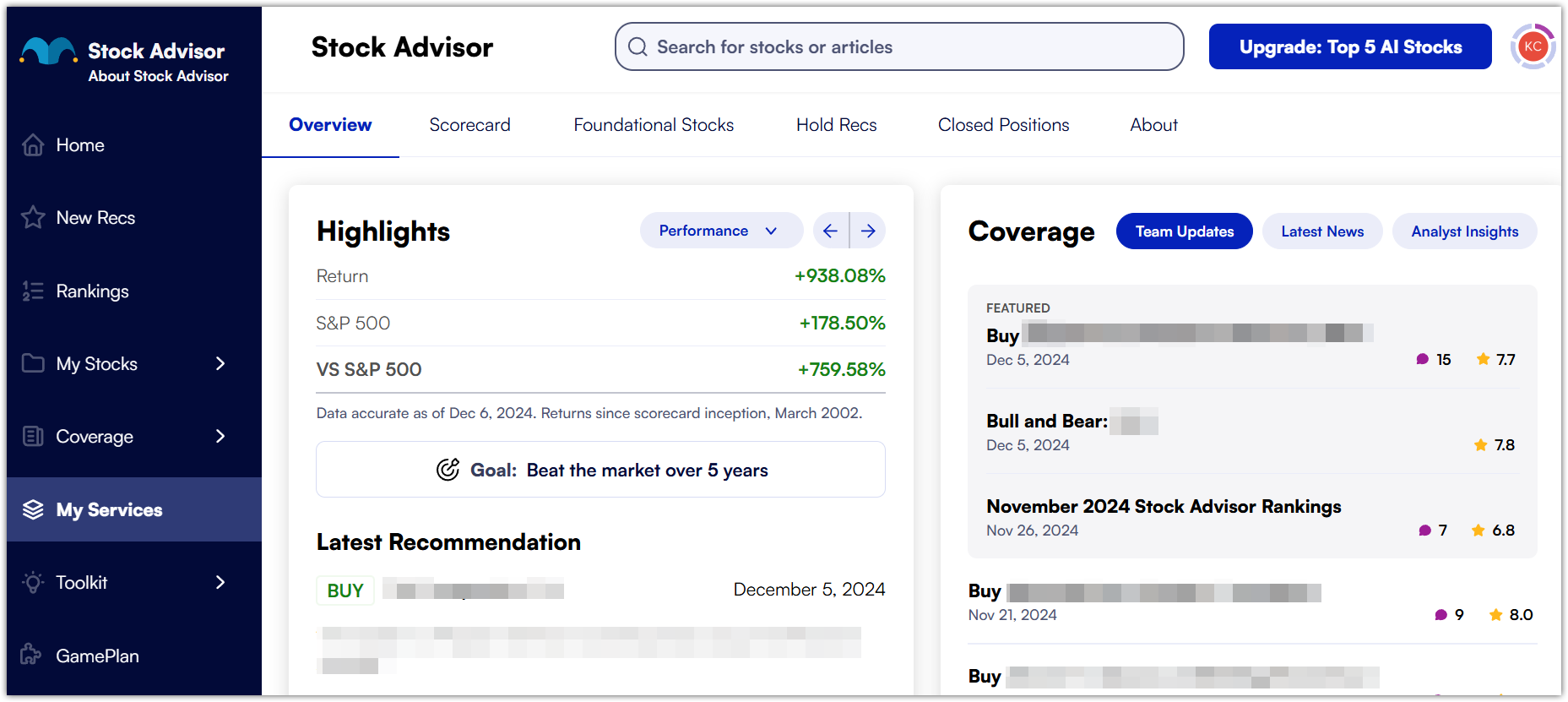

Overall, Stock Advisor’s setup is very well laid out and easy to follow, which I guess is one reason why they’ve had so much success with this service.

That said, there is quite a lot going on inside the dashboard and it can be a little overwhelming at first.

Going to the My Services tab, I can see the proclaimed return from Stock Advisor, which they tell us is +938.08% at the moment (more on this), the latest recommendation, and more.

- If you go to the Coverage tab (on the left) you’ll find articles, the video library, daily news and updates, and, maybe most importantly, their buy/sell recommendation reports

*These reports are easy to follow – go over what they’re investing in and why, risk analysis, and whether or not it’s a good fit for you. Also, members can comment down below the articles which I find very helpful as it gives more of a community feel.

- My Stocks (tab on the left) is where you can add the stocks you’ve invested in to the list and track your portfolio’s performance.

- Rankings (tab on the left) gives you the 10 stocks out of all their recommendations that have the highest ‘ability to beat the market over the next 5 years’

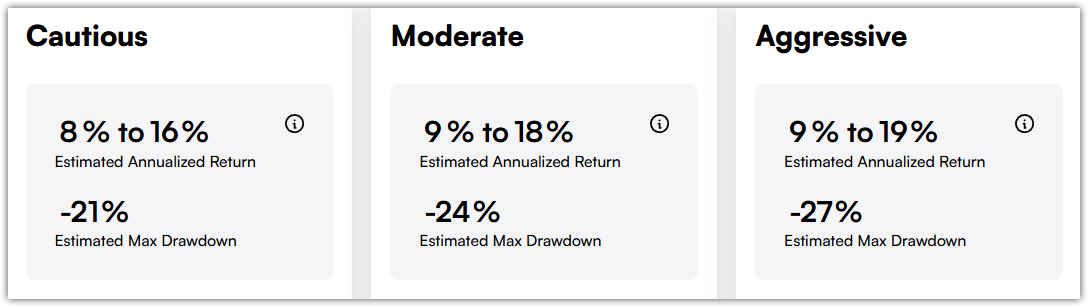

- Gameplan (tab on the left) that lays out an investment plan for you based on the investing type you choose (cautious, moderate, aggressive) – really doesn’t make too much of a difference since the Stock Advisor as a whole leans more towards the cautious and away from the aggressive investments

Also, it doesn’t matter which you choose, their ‘Foundational Stocks are always going to be recommended buys (they have 10 of these stocks).

There’s also the:

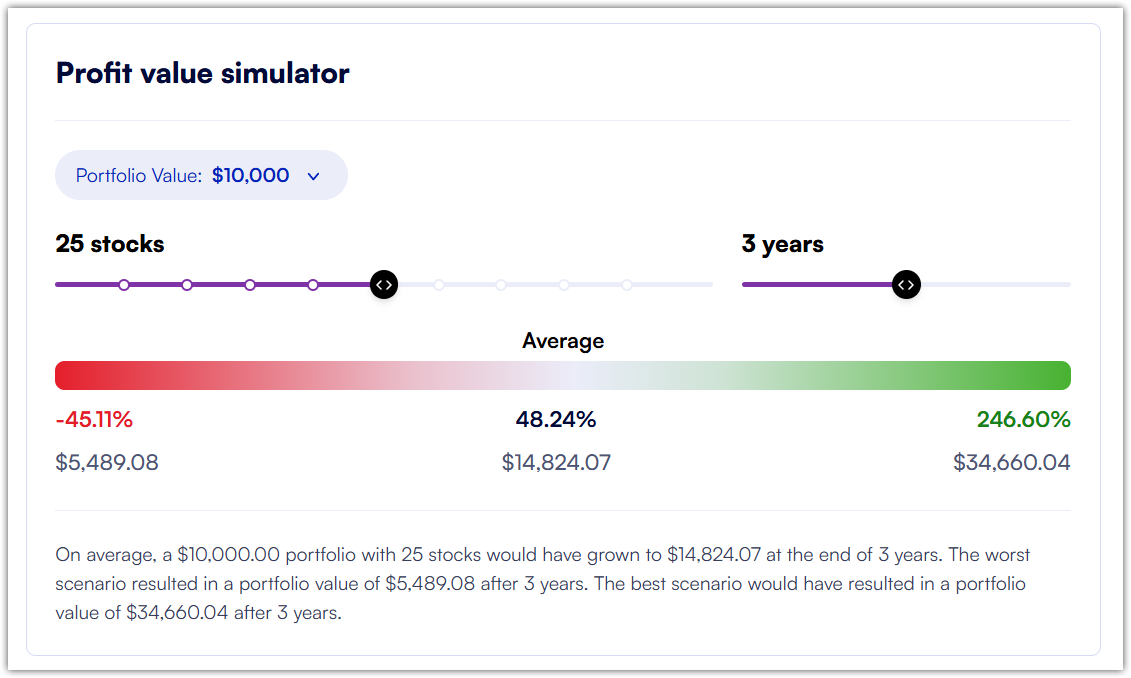

- Toolkit (tab on the left) that gives you access to some basic tools, such as a ‘Profit value simulator’ that shows you about how much you can expect to profit from your initial investment after so many years..

Overall, the layout is great.

Even if someone with no experience in investing were to join, I think they’d be able to sort things out with the guidance provided.

But, just because it looks nice doesn’t mean squat.

Here at stock sleuther, I like to look at performance.

How well are their stock recommendations actually performing?

A look at Stock Advisor’s performance

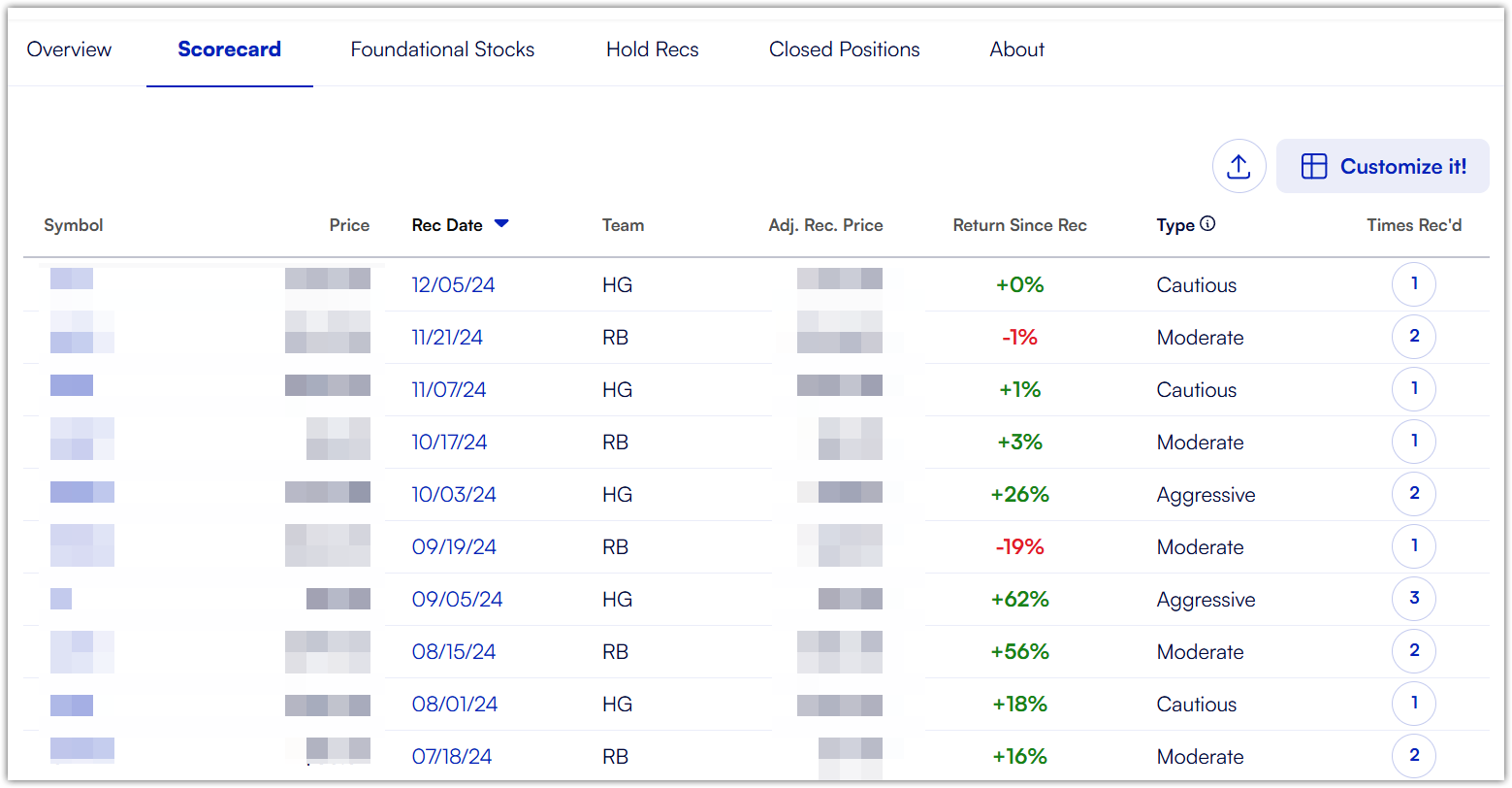

You can find the model portfolio in the Scorecard tab (top tab) if you’re already on the My Services tab.

Here you can find all their current investments, and the nice part is that there’s a lot of data you can show. The table is customizable.

But, I’m not here to show you all the ways you can customize this report, I’m here to crunch numbers and see how well these picks perform.

At the moment (Dec 10, 2024), there are 300 stock picks here.

*Yes, 300, which is a lot. They don't expect members to buy all of these, which is why they provide guidance on what to buy, they're list of 10 'foundational stocks' and so on.

And, at the moment, there are 241 Closed Positions. However, 3 of them don’t have return % data and so I’ve only been able to use 238 of them in my calculations.

After crunching the numbers in Google Sheets I came up with an average return of 935.34%.

Considering that when I converted all the numbers in Google Sheets to percentages and ended up having many rounded to the nearest decimal point, I suppose the 938.08% is probably accurate.

Closed Positions vs Open Positions

For the 238 closed positions, we get an average of 66%. Nothing too special here.

But, for the 300 positions that are still open, the average comes out to 1,654%. Significantly better.

But.. most of these gains come from a few top performers

You probably already guessed this.

If I take the average return of all of their recommendations, closed and current, and then remove some of the top performers here’s what it looks like:

- Average = 935.34% (I’ll use my calculated average)

- Average minus top performer = 790.95%

- Average minus top 2 performers = 698.69%

- Average minus top 3 performers = 625.03%

- Average minus top 10 performers = 268.12%

Still, not too bad. Even if I remove the top 10 performers it’s a 268.12% average.

But, considering that many of their positions have been held for well over a decade… I’m not too sure how good that really is.

Not only this, but imagine if you hadn’t bought those top performers. That would make a big difference in your potential gains.

*It's also worth noting that ALL of those top 10 performers were recommended in 2012 and prior.

The best performer in the past 5 years (2020-2024) has only brought in 1,257%, and the next best only 281%, with the average return of all closed and current positions being 85.54%.

If we look at the average over the past 10 years (2015-2024) of recommendations we get 153.24%.

So, this gives you some perspective.

If you had bought into Stock Adviser at the very beginning of 2020 and invested equally in every single recommendation, you would have made 85.54%.

It certainly isn’t bad, but it’s definitely nothing exciting either. Not like that 900+% that they show off.

Who are the people making these recommendations?

If you look at all the recommendations made for Stock Advisor members, you’ll see that there is a team behind each – either Team HG or Team RB.

Team HG (Hidden Gems) used be called Team Tom and is the one lead by Tom Gardner, one of the founding members of TMF and the one who get’s the last say on what stock to recommend each month.

Team HG is focused on finding companies that have catalysts for future growth but that don’t have media attention surrounding this, meaning that the market usually hasn’t priced in these catalysts and they are still trading at low levels.

Team RB (Rule Breakers) is the name of David Gardner’s team, who’s the other founder/brother at TMF. Besides David, the team consists of Andy Cross, Emily Flippen and Asit Sharma.

Really there isn’t much more information that I could find on the teams here. I had to ask in the community forum to be able to find out what information I could.

Refund policy

I already covered the fact that Stock Advisor has a 30-day money-back refund policy at the beginning. However, I’ve learned over the years that just because a company like this says they will give you a refund within this time period doesn’t mean it will be easy.

So, I tested it out. I requested a refund.

Within the membership area I couldn’t find anywhere to actually request a refund. When I went inside my account there was a button to cancel my membership – they make this very simple – but no easy button to click to cancel the membership.

So, what I had to do was contact their support team at MemberSupport@Fool.com.

It was pretty simple. After doing so, here’s the reply I got:

Dear Kyle,

This email serves as your confirmation that we have canceled your Stock Advisor subscription and will issue a refund of $98.00. Please note that if a state sales tax was collected during the billing, taxes will be refunded as well.

We will submit a refund back to your payment method(s) used for the original purchase. You will see the refund on your statement within 3-5 business days – once your credit card company or bank has processed it. It will be issued by “The Motley Fool” or “TMF”. If you don’t see it within that time frame or on your next statement, please let us know. Our Member Services team will be happy to help.

The refunded money was back in my account within 3 days of this email.

So, good on TMF for this. This process was easy enough.

What I don’t like about Stock Advisor

1) They have a quota to meet

If you join Stock Advisor things are pretty straightforward.

You’ll get 2 stock picks per month.

This is how it works, and while I like how structured the service is, I often think that this isn’t the best way to go about things.

This then pushes them to make recommendations when, quite possibly, they don’t have any good recommendations to make.

This said, they certainly aren’t afraid of recommending the same stock more than once. In fact, I recently saw an ad from TMF talking about their first ever 9x recommendation – meaning the first stock they’ve ever recommended a whopping 9 times – turned out to be Shopify I believe.

So, this is good because if the teams behind Stock Advisor don’t really have any new stocks to recommend, they can always meat that 2x per month quota by re-recommending old stocks, but I still think this quota is unnecessary and know that a lot of services with similar requirements often just recommend a bunch of junk when they don’t know what to do but need to meet that quota.

2) Ads

This annoys me a bit. I mean, I already know that they have other products to upsell me on, but this doesn’t mean that they have to keep putting them in my face to try to get me to buy more.

I just want Stock Advisor.

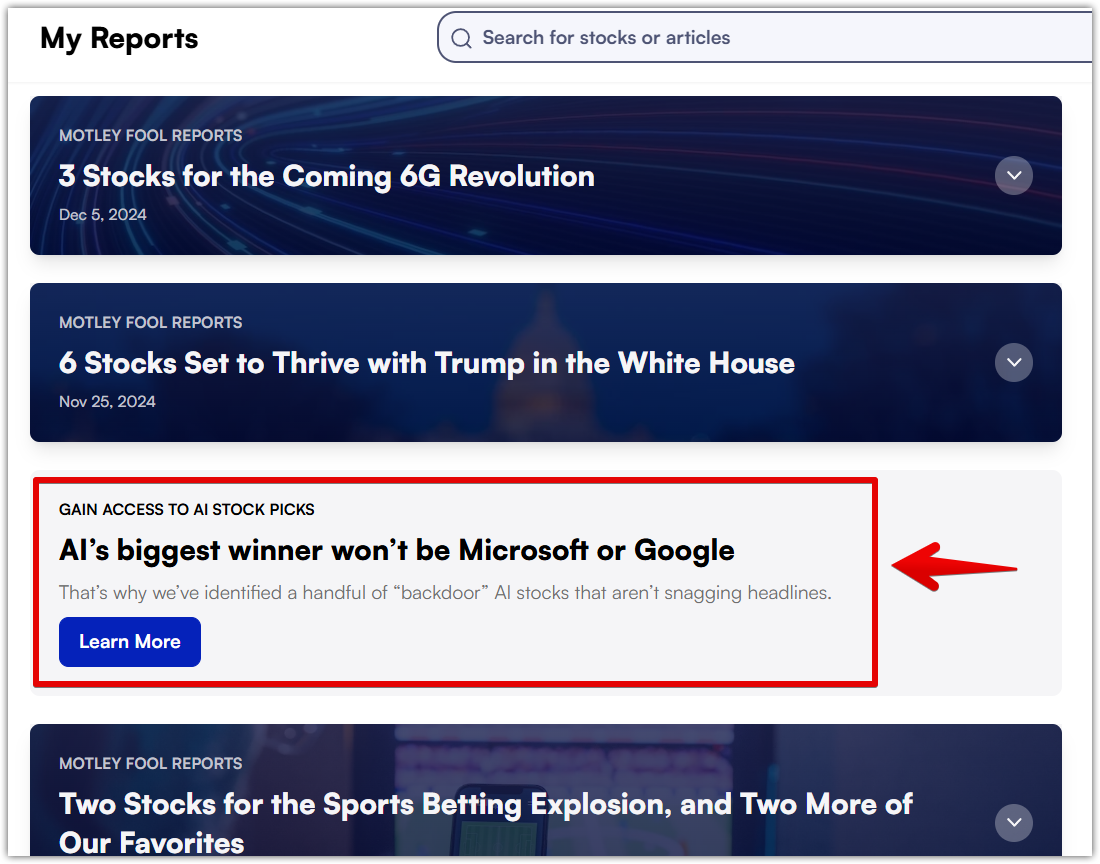

Unfortunately, when I’m navigating around the member’s area I’ll see ads for their upsells thrown in every so often.

For example, this special report for AI stocks… which I would have to pay extra for.

It’s a bit annoying that I can’t even make my way around the member’s area without things like this… and of course you’ll definitely be getting promotional emails for their various upsells if you join as well.

Conclusion: Worth joining or not?

Motley Fool’s Stock Advisor is easily one of the most popular investment newsletter services out there, and for good reason.

For one, the average return for their recommendations is extremely high as I’ve gone over – over 900%.

This, combined with their experience in the newsletter industry (been around since 2002) and the millions of dollars they spend marketing the heck out of their newest opportunities is the perfect recipe to really bring in a lot of subscribers.

However, as I went into in great detail, let’s not forget that the average return over the past 5 years is around just 85%… to bring things back down to reality.

This said, it’s still not bad and I can say that the membership really provides a lot of information.

I’d say it’s most suitable for people looking to get their feet wet in the stock investment world but who don’t really know where to start. They provide a lot of guidance and make suggestions more tailored to your situation and how much money you have to invest (ei. your risk profile and the Foundational Stocks they list).

But before you go out and join, I always think it’s a good idea to hear from other members as well, not just me.

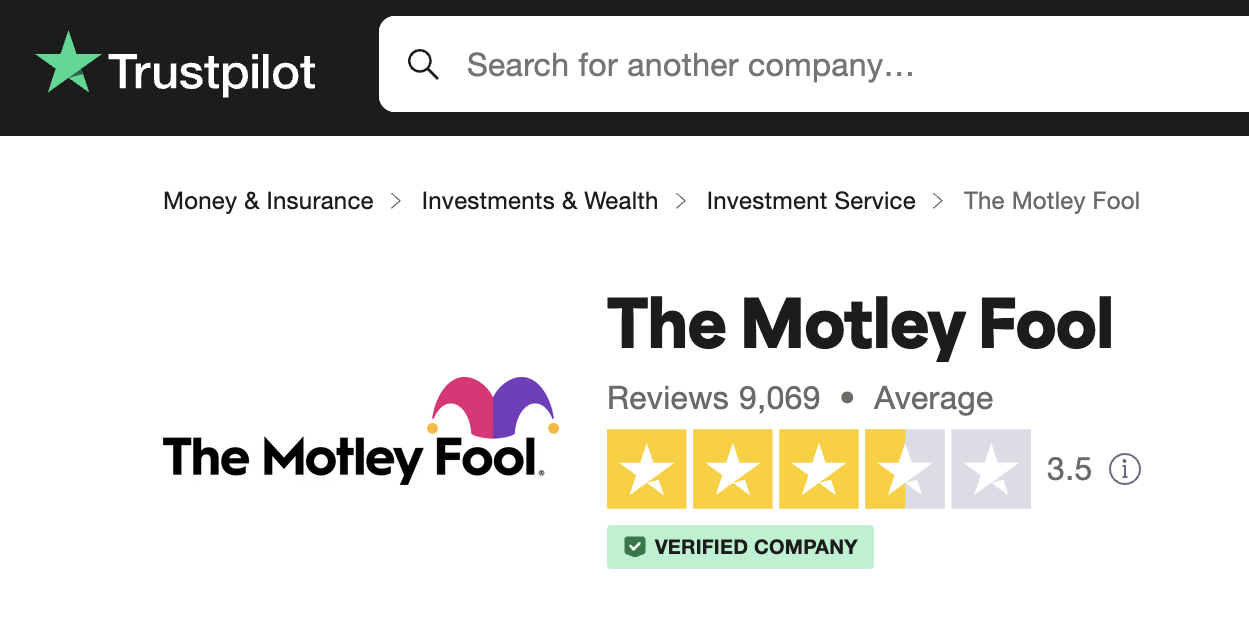

If we go to Trustpilot, we see an average rating of 3.5 out of 5 stars. Not a run for the hills rating, but not good either.

Many of the more negative review come from members who are disappointed because of how most of their products, such as Stock Advisor, are oversold and often set people up for disappointment… especially if you’re expecting an average return of 900+%.

Just as comparison, many of the investment newsletter services out there have absolutely horrible ratings on public review sites like Trustpilot, often because of their somewhat misleading marketing tactics to lure in unsuspecting subscribers.

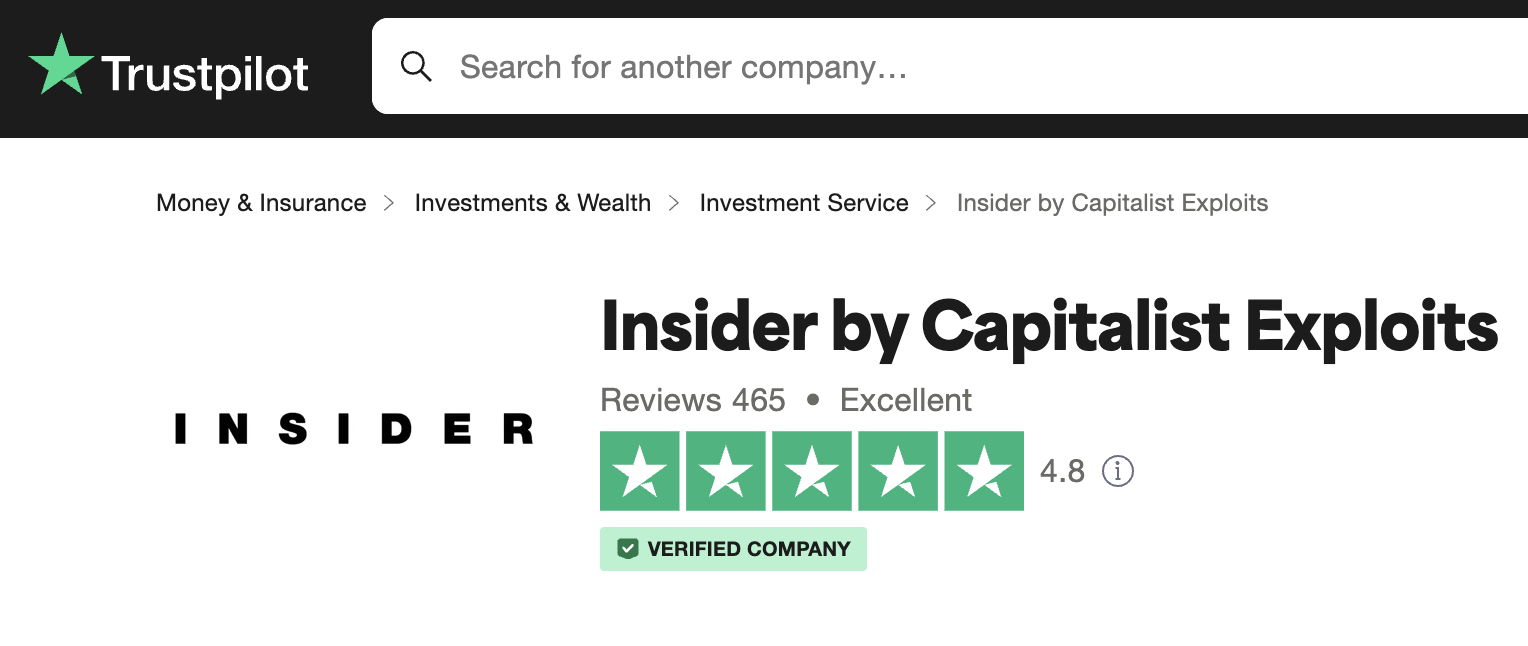

However, and I’m pretty proud of this, the investment newsletter service that I recommend above all others and that I’m personally a member of, has a 4.8 out of 5 star rating on the site – which is nearly unheard of especially in this industry.

The guys at Capitalist Exploits run what they call the Insider Newsletter, which is a mostly contrarian-focused investment newsletter that does the opposite of what most do – instead of looking for ‘hot’ new stocks that are trending, they look for the old dogs that have been forgotten and are trading at rock-bottom prices.

The best part… they do this while targeting 3x gains at a minimum.

I’ve been a member since September of 2020 and will probably stay a member for life. The investment guidance is absolutely golden.

The only small downside when compared with a service like Stock Advisor is that Insider Newsletter isn’t so much of a handholding service – meaning the members area isn’t as nice and they don’t provide quite as much guidance.

But this is expected considering Insider Newsletter is run by 2 money managers and an absolutely tiny team behind it all.

My suggestion: check out my write-up on Insider Newsletter here.

As always, I hope you’ve found this review helpful and be sure to leave a comment down below. Let me know what you think!